Instant Loan Things To Know Before You Get This

Wiki Article

7 Easy Facts About Best Personal Loans Explained

Table of ContentsInstant Cash Advance App Can Be Fun For Everyone3 Easy Facts About Loan Apps ShownFacts About $100 Loan Instant App UncoveredThe smart Trick of Instant Cash Advance App That Nobody is DiscussingAll About Loan AppsThe Best Guide To Instant Cash Advance App

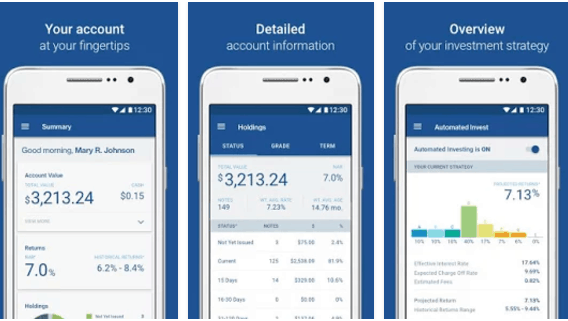

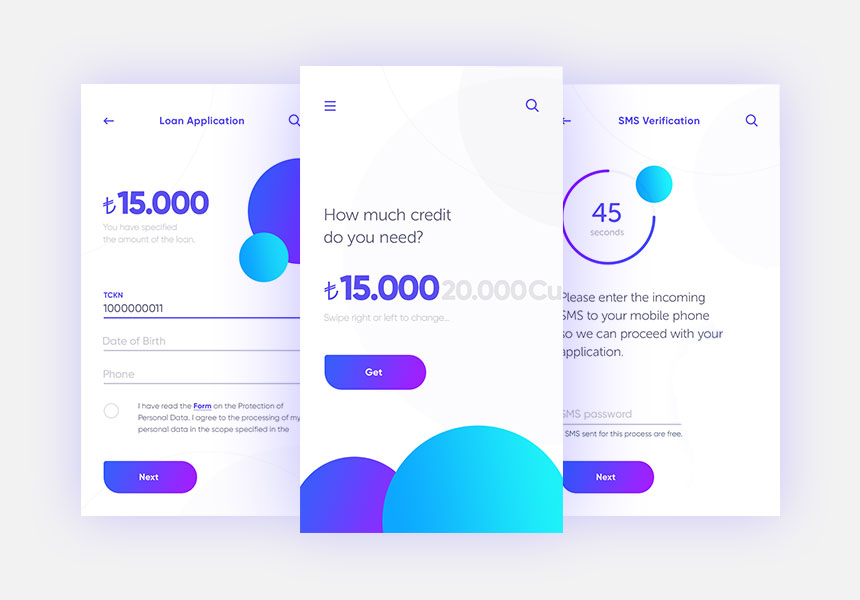

When we think of applying for fundings, the imagery that comes to mind is people lining up in queues, awaiting countless follow-ups, and also obtaining absolutely annoyed. But technology, as we understand it, has altered the face of the lending organization. In today's economic climate, consumers as well as not lenders hold the trick.Funding approval and documents to finance processing, everything is online. The lots of relied on online lending applications use consumers a system to obtain car loans easily as well as give authorization in minutes. You can take an from a few of the very best cash financing applications readily available for download on Google Play Store and also Application Shop.

You simply need to download the application or most likely to the Pay, Feeling internet site, authorize up, submit the called for papers, as well as your finance will get approved. You will certainly obtain alerted when your finance demand is refined. Commonly financing application utilized to take at the very least a few days. In many cases, the funding authorization used to obtain extended to over a month.

Loan Apps Things To Know Before You Get This

Commonly, even after getting your lending authorized, the procedure of getting the lending amount transferred to you can require time and get complicated. But that is not the case with on the internet lending applications that supply a straight transfer alternative. Instant funding applications provide immediate individual financings in the series of Rs.

5,00,000 - best personal loans. You can use an immediate lending according to your eligibility as well as need from instant funding apps. You don't have to stress the next time you desire to make use of a small-ticket financing as you know how beneficial it is to take a lending using on-line financing applications. So, get rid of the taxing and tiresome process of availing of standard personal lendings.

7 Easy Facts About $100 Loan Instant App Shown

By digitizing as well as automating the financing procedure, the system is changing conventional banks into digital lending institutions. In this article, let's check out the benefits that a digital lending platform can bring to the table: what's in it for both financial institutions as well as their customers, and how digital financing platforms are disrupting the industry.They can even scan the financial institution statements for info within only secs. These attributes help to make certain a rapid and practical individual experience. The electronic banking Read Full Article landscape is now extra vibrant than ever. Every financial institution now desires everything, consisting of lendings, to be refined instantaneously in real-time. Customers are no much longer ready to wait for days - not to state to leave my latest blog post their houses - for a finance.

Some Known Details About Instant Cash Advance App

All of their daily tasks, consisting of financial transactions for all their activities and also they like doing their financial purchases on it as well. They desire the convenience of making purchases or applying for a funding anytime from anywhere - instant cash advance app.In this situation, electronic financing systems act as a one-stop service with little manual data input as well as rapid turn-around time from lending application to cash in the account. Consumers need to be able to relocate effortlessly from one gadget to one more to complete the application kinds, be it the web and mobile interfaces.

Carriers of digital lending platforms are required to make their products in compliance with these regulations as well as aid the loan providers focus on their business just. Lenders likewise needs to ensure that the carriers are upgraded with all the most recent guidelines released by the Regulators to quickly integrate them into the electronic loaning platform.

Not known Details About Instant Loan

As time passes, digital borrowing systems can assist in saving 30 to 50% expenses costs. The typical hands-on financing system was a discomfort for both lender as well as customer. It relies upon human treatment as well as physical interaction at every step. Customers needed to make multiple journeys to the financial institutions and also send all kinds of papers, and by hand submit numerous kinds.The Digital Lending system has actually changed the means financial institutions assume about and also execute Discover More their finance procurement. Banks can currently release a fully-digital lending cycle leveraging the current advancements. A wonderful digital financing system have to have easy application entry, fast authorizations, certified lending procedures, as well as the ability to continually boost process efficiency.

If you're assuming of going right into borrowing, these are reassuring numbers. At its core, fintech is all regarding making traditional financial processes much faster and also extra efficient.

Top Guidelines Of $100 Loan Instant App

Among the typical misunderstandings is that fintech applications only profit banks. That's not completely true. The application of fintech is currently spilling from financial institutions and lending institutions to local business. This isn't unexpected, considering that local business need automation and also digital technology to optimize their restricted resources. Marwan Forzley, CEO of the repayment platform Veem, amounts it finest: "Local business are wanting to outsource intricacy to somebody else due to the fact that they have enough to fret around.A Kearney study backs this up: Source: Kearney As you can see, the convenience of use tops the list, revealing how availability as well as convenience given by fintech systems represent a substantial driver for customer commitment. You can apply many fintech technologies to drive client trust and retention for services.

Report this wiki page